I am proudly supporting the Holi Milan Samaroh event organized by Biharis in Vancouver Group. This special gathering is a chance for people from Bihar, Jharkhand, and the Purvanchal region of Uttar Pradesh to reconnect with their roots, enjoy Holi special food, &…

Real Estate

Vivek Canada’s Vasant Utsav – Celebration Of Community, Culture, & Compassion!

Vivek Canada is hosting its annual Vasant Utsav on Saturday, March 1, 2025, at the Taj Park Convention Centre, located at 8580 132 Street, Surrey, BC. Basant or Vasant in Hindi refers to the spring season. Let’s join and welcome spring with a meaningful cause!…

Top 5 Mortgage Tips for First-Time Homebuyers | Neeraj Kumar

Buying your first home is an exciting milestone, but navigating the mortgage process can feel overwhelming. Here are the top five mortgage tips to make your journey smoother: 1. Check and Improve Your Credit Score Your credit score plays a significant role in…

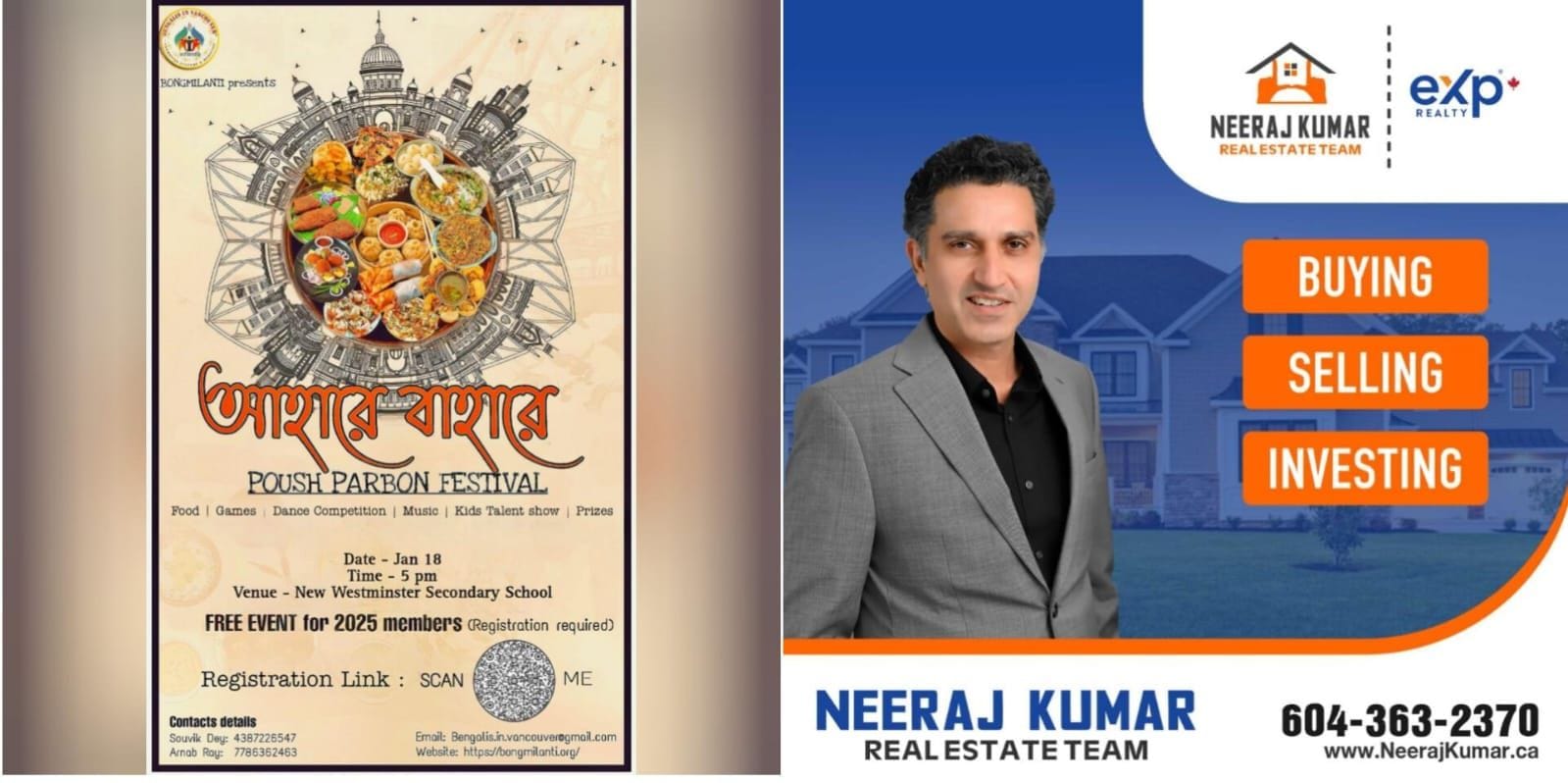

Bengali Food Festival in New Westminster | Proud Sponsor | Neeraj Kumar

Bengali Food Festival is coming to New Westminster this Saturday, January 18, 2025. The event is hosted by BongMilanti – Metro Vancouver Bengali Cultural Association at New Westminster Secondary School. The organizers are claiming that it is going to be the…

House Hunting Tips | Real Estate Blog by Neeraj Kumar

Picking your neighborhood is an important aspect of house hunting. Here are some tips to help: 1. Infrastructure Roads and easy connectivity is a positive sign of good neighborhood. Look for areas with good quality public infrastructure. 2. Community Neighborhoods…

First Time Home Buyers Seminar

Updated for Seminar coming up on March 3, 2024 Come and join us for an Information Session for the First Time Home Buyers and get yourself educated to know what is required to buy your first home in BC, Canada. What to expect in this First-Time Home Buyers Seminar…

What Determines the Property Value? Know your facts!

Determining property value is not limited to when you want to sell. With the ever-changing Vancouver real estate market, it is important to stay on top of what your property is worth. There are several factors that will affect and change property value. Here are the…

First Time Home Buyers? Attend This Free Information Session

Are you planning to buy a home in Vancouver area? Attend the free information session that I organize couple of times in an year & prepare yourselves and get the knowledge you need to understand the process of home buying in BC. We will try to cover the following…

Real Estate Market in Metro Vancouver

Connect with Neeraj Kumar if you are wondering how is real estate market is doing in Vancouver. Neeraj can Provide Great Insights of Real Estate in your neighborhood. Call him today at 604-363-2370 or visit his real estate website http://www.nkumar.ca to find your…

Top 5 Tips For First Time Home Buyers

1. Determine how much you can afford This should be first thing you should do. Talk to mortgage professional such as Mortgage Broker and check how much you can afford. 2. Prepare a Budget – Do not forget about the closing costs There are some closing costs…

Understanding The Contract of Purchase and Sale (CPS) – BC Real Estate

The Contract of Purchase and Sale (CPS) form in BC is the document that outlines the terms of the offer from a buyer to a seller in a real estate transaction. Watch this video below and understand the process. The British Columbia Real Estate Association (BCREA) has…